Cooperative businesses and mutual societies carry far more of New Zealand’s economic and social weight than most people appreciate. New Zealand has almost 300 co-ops and mutuals, and the top 30 alone generate over $51.9b in revenue and directly employ close to 49,000 people. They last longer as well. On average, five times longer than a regular New Zealand company.

To explain the sector’s trajectory and get the latest update, we spoke with Saya Wahrlich, CEO of Cooperative Business New Zealand, the national peak body representing the country’s co-ops and mutuals. She offered wide ranging insights on where the sector is heading, the gaps that still exist and the kind of specialist support co-ops need around them.

These enterprises are people-centred and are democratically controlled by their members through the “one member, one vote” rule, prioritising shared values and fairness over pure profit. A mutual is a private company owned by its clients or policyholders, where the primary purpose is to provide mutual benefits to its members rather than generating profits for external shareholders. Mutuals are most commonly found in the finance and insurance sectors. All mutuals are cooperatives, but not all cooperatives are mutuals. As Saya notes, “The ownership structure changes everything. Governance, risk, decision-making and capital all behave differently in co-operatives and mutuals.”

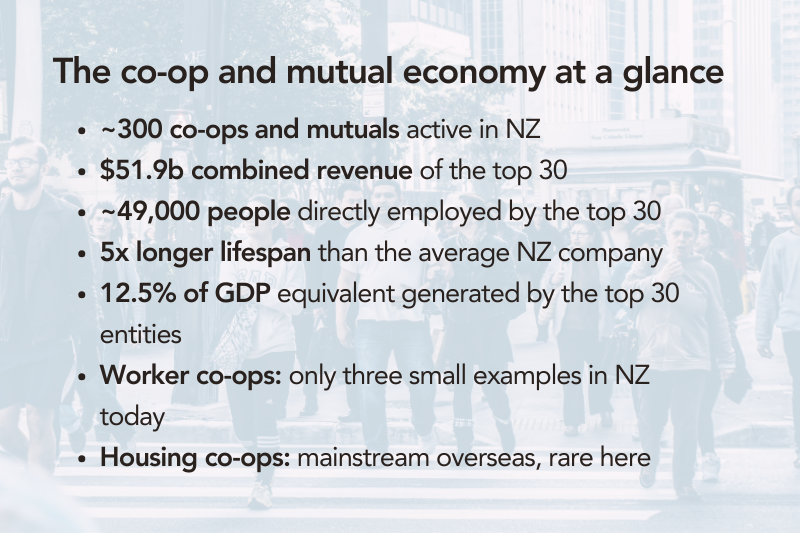

To understand the scale and significance of the sector in New Zealand, the numbers tell a compelling story.

These numbers show why sector understanding is essential and why co-ops and mutuals are by no means niche.

What’s ahead for NZ Cooperatives and Mutuals?

CEO Saya Wahrlich highlighted three priorities in the year ahead: succession, with many member-owned organisations facing governance and leadership continuity challenges across boards, management teams and intergenerational ownership; access to capital, as organisations navigate growth while staying true to member ownership and avoiding investment structures that compromise their model; and education, with both a new map for people to find their local co-op or mutual, plus the launch of the Co-op Academy to demystify co-operative governance for founders, directors, advisers and professionals who are new to member-owned organisations.

The co-op and mutual world covers food, farming, retail, health insurance, irrigation, regional infrastructure and export markets. Many household names sit inside the model. But the model is unevenly developed. As Saya notes, “We are a very cooperative country. It’s in our cultural DNA. Imagine what else could we do if we embraced housing co-ops and worker co-ops too?”

Housing co-ops could offer stability and affordability. Worker co-ops could offer resilience and shared ownership. Both are normal overseas. Both are thin on the ground here.

Strengthening the professional scaffolding around established co-ops and mutuals is part of helping the sector grow. And Audit sits inside that scaffolding.

Why a great Audit partner matters

Co-operative businesses and mutual societies need audit partners who understand governance through a member-owned lens. BVO Audit has developed meaningful experience here, including supporting Cooperative Business New Zealand itself.

The fundamentals of co-ops and mutuals:

- one member, one vote, and the governance flow-on

• member value, not investor return

• capital that exists for service, not extraction

• horizontal accountability within communities

• (sometimes) a long horizon for decision-making

As BVO Director Alex Houghton puts it, “co-operatives and mutuals are purpose-driven by design. They are built on trust, accountability and long-term value. Supporting organisations with a clear purpose and a strong operational base aligns with why we do the work we do.”

The bottom line

A standard corporate audit framework can identify compliance issues, but it often overlooks the underlying dynamics.

Co-ops and mutuals operate on a fundamentally different logic that requires a deeper understanding. The right audit partner can reinforce the governance culture that keeps co-operatives and mutuals enduring and trusted.

And we all have a role to play. As Saya says, “In a tight economy, conscious choices matter. When you support a co-operative or a mutual, that money stays in New Zealand and benefits the community. Choosing an audit partner is the same. Pick one that understands your model and strengthens it.”

To hear more about the experience of working with BVO Audit check out our case study here.